AI for AI: Additive infrastructure for artificial intelligence

Artificial Intelligence (AI) and electricity rely on large and fast-growing infrastructures. Staking an infrastructural lead in powering AI can have an impact on technology leadership, competitiveness and national security. US AI dominance, in part, requires energy security to undergird the buildout of data centers, of grid capacity to power them, and of a manufacturing base to supply both.

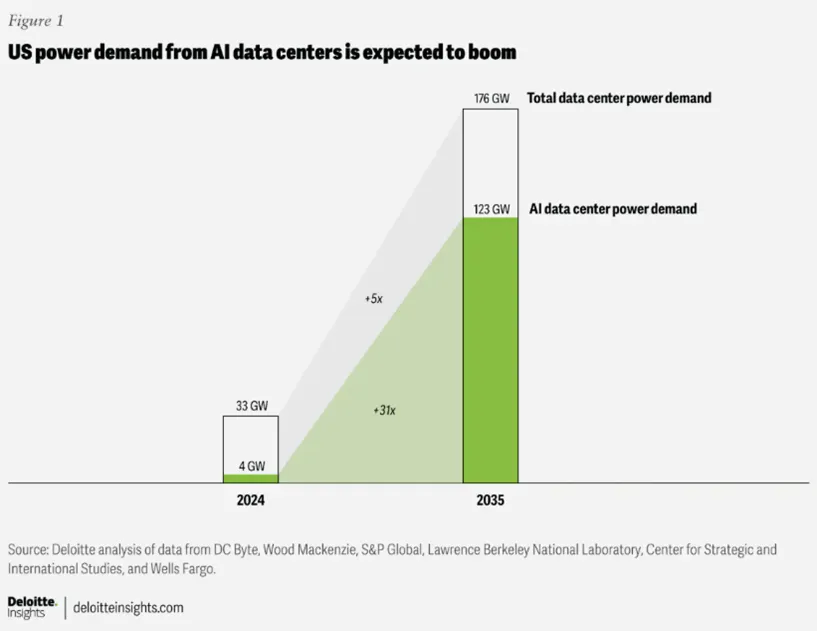

Deloitte estimates US AI data center power demand will grow more than thirtyfold by 2035, from 4 GW in 2024 to 123 GW (figure 1).1 While AI accounted for only 12% of the 33 GW in data center demand in 2024, it is poised to account for most of the growth over the next decade, accounting for 70% of the 176 GW in data center demand by 2035.2 The infrastructure to serve this demand is expected to be additive in scope and scale to existing data center, power, and manufacturing assets, as the stakes for the industries involved have grown and speed bumps emerge.

The infrastructural scope is expected to be increasingly complex. Data center developers can involve Big Tech, real estate, investment funds, and IT departments across industries; utilities, power and gas companies and renewable developers; and construction companies and manufacturers of resources ranging from nanometer semiconductors to hundred-meter turbines. This convergence could redefine the scope of infrastructure development across these industries.

Scale: from megawatts to gigawattsThe infrastructural scale of AI datacenters and their power needs is growing. Data centers serving AI workloads have replaced general-purpose central processing units with the specialized graphics processing units needed to serve AI workloads.3 This could increase a small, under 5-acre data center’s energy usage tenfold, from 5 to 50 MW, while freeing enough row space to further grow to 500 MW.4 Meanwhile, some hyperscalers and AI companies are planning data center campuses as large as 50,000 acres consuming 5,000 MW5 – more than the capacity of the largest existing nuclear or gas plants in the US.6

The growth is also reflected in the expanding range of investment in data centers currently under development, from a hyperscaler building a data center for close to $500 million to joint ventures in AI infrastructure planning to invest $500 billion.7 The latter’s gigawatt-scale data centers would house 2 million GPUs – more than all purchases of AI chips from a leading provider by the four leading public cloud vendors in 2024.8

Stakes: trillion-dollar questionsThe changing scope and scale of infrastructure development may increase the stakes of building out capacity for data centers, power generation, and manufacturing. Some energy utilities are planning a record increase in capex, expected to jump 22% year-over-year to $212 billion in 2025 across 47 utilities – a sharp rise from the 7.6% CAGR over the past decade.9

Meanwhile, traditionally capital-light hyperscalers surpassed capital-intensive utilities in capex in 2024.10 Some tech companies are planning a 44% increase to $371 billion for AI data centers and computing resources across eight hyperscalers.11

- Energy utility capex is expected to surpass $1 trillion cumulatively from 2025-2029 within the next five cumulative years for the 47 biggest investor-owned utilities. For the hyperscalers, the increase is expected in only three years, with spending projections reaching half a trillion dollars annually by the early 2030s.12

- The broader tech industry has also announced plans to invest more than a trillion dollars in US manufacturing of AI supercomputers, chips, and servers over the next four years.13

- As the market waits for trillion-dollar AI applications and returns to materialize, fears that cheaper models could undermine some hyperscalers’ high-capex premise have arisen and driven market volatility.14

The continued capex reflects an idea that AI could rank with electricity as one of the world’s most transformative technologies.

Speed to market and powerThe speed to market sought for AI advancement seems to have challenged infrastructure development. In pivoting from traditional to AI data centers, tech companies may have scrapped data center construction underway, redesigned cooling solutions, and struggled to secure sufficient chip supply. Some manufacturers have scrambled to respond to increases in demand for computing and power equipment from utilities and gas companies striving to seize new growth opportunities: the impact is reflected in investor earnings call transcripts in the manufacturing and energy sectors, where mentions of “data center” grew fivefold to a record high in 2024.15

The speed of AI market development appears to have challenged utilities and grid operators struggling to accurately forecast load. Most power company and data center respondents of the Deloitte 2025 AI Infrastructure Survey share the perspective that AI will increase power demand through 2035 due to widespread adoption (79%), although power companies were more sanguine that AI could stabilize demand by then due to efficiency improvements.16

The Deloitte Center for Energy and Industrials conducted a survey in April 2025 to identify the challenges, opportunities, and strategies of US data centers and power companies, and to benchmark their infrastructure development. The survey sample of 120 respondents included 60 data center executives and 60 power company executives, who responded to questions on infrastructure build-out challenges, resource mix to meet future energy consumption, workforce issues, AI workload planning, drivers of load growth, and investment priorities.

However, the range of growth estimates varies widely across infrastructure industry players depending on assumptions about the evolution, production, and sales of chips; shares of AI inference and training, or their convergence; computing and cooling efficiency gains; resource limitations; and demand for AI services.17 The uncertainty may increase the risk for utilities of either saddling households with the costs of overbuilding infrastructure or missing growth opportunities from the inability to serve new customers.

Speed to power has become a defining question for AI infrastructure development. While data center developers may have traditionally bid projects in several markets for due diligence purposes, a rush of speculative requests appears to have created overwhelming noise for utilities and slowed the interconnection of new projects. AI data center power demands may have run up against the electric grid’s ability to timely serve their large loads.

Deloitte analysis drawing on insights from the Deloitte 2025 AI Infrastructure Survey of power companies and data centers shows that gaps to powering AI could be addressed by developing additive infrastructure that brings efficiency, capacity, and/or flexibility.

This article contains general information only and Deloitte is not, by means of this article, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This article is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor.

Deloitte shall not be responsible for any loss sustained by any person who relies on this article.

About DeloitteDeloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the “Deloitte” name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

Copyright © 2025 Deloitte Development LLC. All rights reserved.

1. Deloitte used DCByte data on live, under construction, committed, and early-stage data center IT capacity and North American forecasts through 2030, as well as pipeline estimates from WoodMackenzie and studies tracking chip shipments to determine current total data center capacity and derive operational capacity in 2035. We further validated against AI data center penetration estimates and forecasts through 2035, and the application of a 24% CAGR through 2030, and 8% through 2035 to reflect efficiency gains.

2. Analysis by the Deloitte Research Center for Energy and Industrials of data from DC Byte; Wells Fargo; Cy McGeady, Joseph Majkut, Barath Harithas, and Karl Smith, “The electricity supply bottleneck on U.S. AI Dominance,” The Center of Strategic and International Studies, March 2025; Cecilia Springer and Ali Hasanbeigi, "Data centers in the AI era: Energy and emissions impacts in the U.S. and key states," Global Efficiency Institute, February 2025; and Arman Shehabi et al., "2024 United States data center energy usage report," Lawrence Berkeley National Laboratory, December 2024.

15. Deloitte analysis of earnings calls transcripts.

16. Deloitte 2025 AI Infrastructure Survey

17. Deloitte analysis of industry estimates

utilitydive