Climeworks Is Cutting 22% of Staff as US Climate Backlash Hits Carbon Removal

By Akshat Rathi and Coco Liu

Founded in 2009, Climeworks constructed a pilot plant in Iceland in 2021 followed by a larger version that began operations in 2024 and is still being built out. Photographer: Heida Helgadottir/Bloomberg

Climeworks AG is laying off 106 people, as startups that aim to reverse global warming face a reckoning with the US government slashing climate incentives and programs.

The Swiss startup was one of the first companies to develop direct-air capture (DAC) technology to suck carbon dioxide from the sky. It was set to start work building its largest to capture as much as 1 million tons of planet-warming carbon dioxide from the air after receiving a $50 million US government grant last year, with the possibility of securing a further $500 million during construction.

Since then, President Donald Trump’s administration has launched reviews and pulled back government support for many carbon-cutting projects. Though the Energy Department hasn’t axed the program backing Climeworks’ Louisiana plant, its future remains unclear.

“We are prepared to move forward with that project, but we also need to consider the scenario that there are changes, or that the administration will not move forward with the project,” Jan Wurzbacher, co-founder and co-chief executive officer of Climeworks, told Bloomberg Green in an exclusive interview.

Jan Wurzbacher at the company’s Mammoth carbon removal plant in Hellisheiði, Iceland, in May 2024.

Before the reductions, the company’s staff count stood at 483. “We are coming out of a phase of extreme growth,” Wurzbacher said. Given unfavorable market conditions, the company is looking to cut costs and become profitable. To do that, “we need to consolidate a little bit,” he said.

Founded in 2009, Climeworks constructed a pilot plant in Iceland in 2021 followed by a larger version that began operations in 2024 and is still being built out.

Climeworks wasn’t just one of the first to capture CO2 from the air: It also worked with Icelandic partners to store it underground. Studies have shown the gas can be mineralized into rock after as little as two years, permanently locking away the planet-warming gas. That’s helped the company raise nearly $800 million, making it one of the best-funded DAC startups.

But the DAC process is energy-intensive and expensive. Climeworks charges individuals $1,000 per ton of CO2 captured. In comparison, the price of one ton of CO2 on Europe’s Emissions Trading System is about €65 ($73).

However, with governments around the world setting net-zero goals over the past decade, it created momentum for companies to start buying high-integrity carbon credits. Climeworks has secured orders to capture 380,000 tons, and there are as many as 140 DAC startups today, according to carbon removal clearinghouse CDR.fyi. Occidental Petroleum Corp. bought one — Carbon Engineering Ltd. — for $1.1 billion in 2023.

But with the Trump administration rolling back climate policies and pushing anti-ESG rhetoric, the market is likely to slow down. It’s happening at a time when these technologies are attempting to scale and are in need of stronger support.

Read More: Big Bets on Carbon Capture Tech Ignore Today’s Solutions

“Pulling back on any of these federal programs at this juncture would be catastrophic to the broader deployment of these technologies in the next decade,” said Jessie Stolark, executive director of the Carbon Capture Coalition, a trade group whose members include Climeworks.

Another challenge is that carbon removal doesn’t have a “natural” market, said Robert Hoglund, co-founder of CDR.fyi. Companies making sustainable aviation fuel, for example, will be able to sell the fuel in the market if they can make it as cheap as fossil fuels. Demand for carbon credits depends on companies voluntarily choosing to offset their emissions.

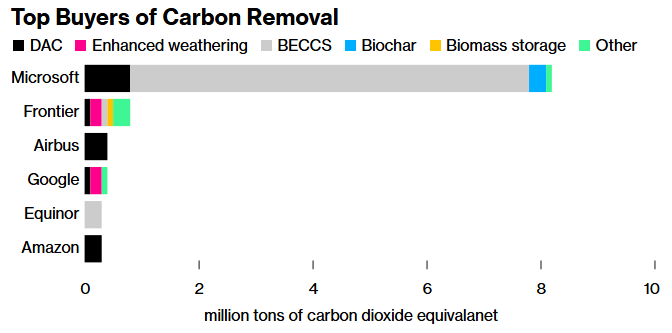

So far, the market has been dominated by one buyer: Microsoft Corp. “Carbon removal as an industry is fragile,” said Eli Mitchell-Larson, co-founder of carbon-removal advocacy group Carbon Gap.

Source: BloombergNEF, CDR.fyi. Note: BECCS refers to bioenergy with carbon capture and storage, DAC refers to direct air capture.

That means carbon removal startups are in a more precarious place than most climate startups. Globally, venture capitalists invested about $110 million in DAC startups during the first quarter of 2025, down by roughly 46% from a year ago, according to Pitchbook.

“I definitely expect quite a few DAC companies to fold this year and next year,” said Hoglund. “In the long run, maybe there will be five or so with the best technologies.”

Despite the job cuts to preserve cash, Wurzbacher says Climeworks is continuing to raise money. And he added that Climeworks is on the lookout for acquisitions in case smaller DAC startups fail to secure funding.

Last year, global average temperatures were 1.5C above pre-industrial levels. The Paris Agreement calls for “pursuing efforts” to keep temperatures below that threshold, which will require not just halting greenhouse gas emissions but also pulling excess from the atmosphere. The best science shows the world will likely need to remove billions of tons a year by mid-century, a scale the carbon removal industry is nowhere close to.

Climeworks’ pilot plant, called Orca, has the annual capacity to trap 4,000 tons of CO2, but it has never captured more than 1,000 tons in any year since its construction was completed in 2021. Wurzbacher said that the company has been able to run the plant at 65% its nameplate capacity in its best month.

Yet he noted the capture technology for Orca is now outdated, meaning it’s not as efficient and has degraded in the four years it has operated. “We have decided not to substantially invest into that plant to squeeze out the last thousand tons,” Wurzbacher said.

Climeworks is building another plant, called Mammoth, with the capacity of 36,000 tons, but Wurzbacher said the construction is running slower than he would like. First operations began in 2024 and it’s working on a three-year ramp-up phase for full capacity.

“We have chosen to take a step-by-step approach,” said Wurzbacher. Climeworks has made a series of improvements going from Orca to Mammoth. But they “also introduced new challenges,” he said. For context, CO2 emissions from fossil fuels and cement were estimated to reach 37.4 billion tons last year, according to the Global Carbon Project.

The next stage in growth is the Louisiana factory as part of Climeworks plan to capture as much as 1 million tons of CO2 per year by 2030 and 1 billion tons by 2050. Given the decisions of the Trump administration, Wurzbacher said it’s clear the Louisiana plant will be delayed. If it is canceled, he said the company could shift focus to projects it has lined up in Canada, Germany and Saudi Arabia—though those would likely be smaller at 200,000 tons per year.

“Policy whiplash hurts not only climate progress, but also business confidence and economic stability,” says Erin Burns, executive director at environmental nonprofit Carbon180.

But investors don’t necessarily see Climeworks’ job cuts as a red flag of deeper troubles for the DAC industry as a whole. “A downsizing like this is just right-sizing the burn and setting the company up to more successfully grow,” says Alex Roetter, managing director at Moxxie Ventures, a San Francisco-based venture capital firm that invests in direct air capture technology. Moxxie isn’t an investor in Climeworks.

— With assistance from Jennifer A Dlouhy, Michelle Ma, and Sommer Saadi

(Updates with context on capacity of plants from 18th paragraph)

Share This:

energynow