Lithium-ion is long-duration energy storage (LDES)

At short durations (≤4 hours), lithium-ion’s high power density makes it the storage technology of choice, with decades of R&D and large-scale use in electric vehicles (EVs) delivering lower costs than anything else.

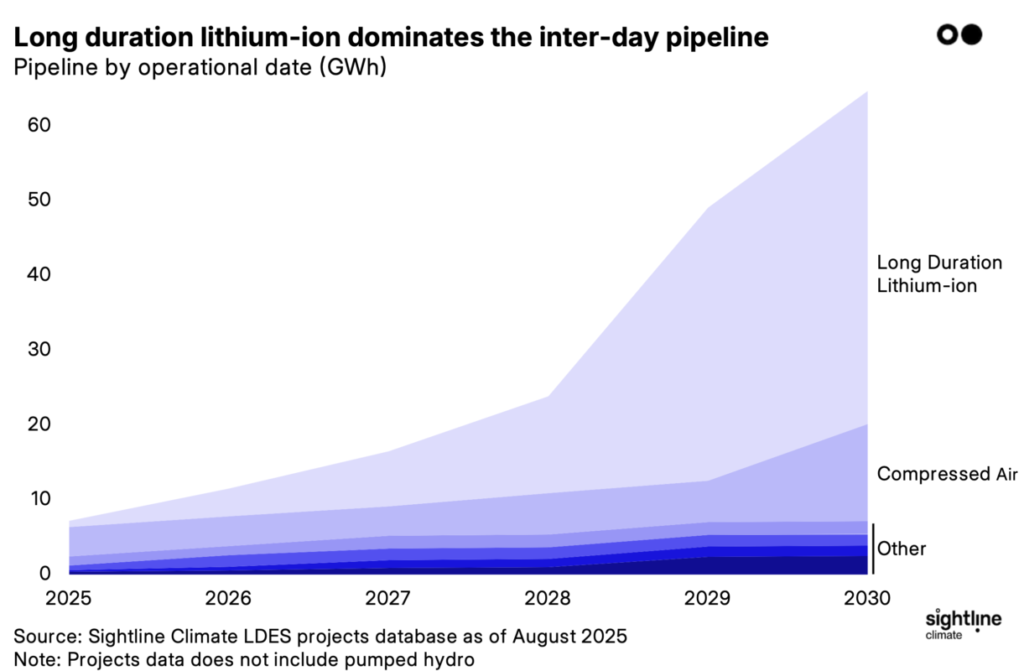

Lithium-ion is set for a repeat performance in inter-day (8-12 hour) long duration energy storage. It already accounts for 70% of the 64.7GWh of inter-day LDES projects that are targeting operations by 2030, more than triple the second most deployed tech, compressed air energy storage (CAES) at 20%.

Alternative battery chemistries, liquid air, and flow batteries combined make up a mere 7%, with all other electrochemical, mechanical, and thermal techs accounting for the remaining 3%.

Emerging technologies are making some progress, but they are scaling more slowly than long duration lithium-ion. Only a handful of commercial projects have reached final investment decision, and even the most ambitious inter-day startups are only targeting a few GWhs online by 2030 (eg 5.6GWh for Hydrostor’s adiabatic compressed air or 0.7GWh for Energy Dome’s liquid CO2 tech).

Even if these startups execute flawlessly, they will enter the 2030s playing catch-up with long duration lithium-ion.

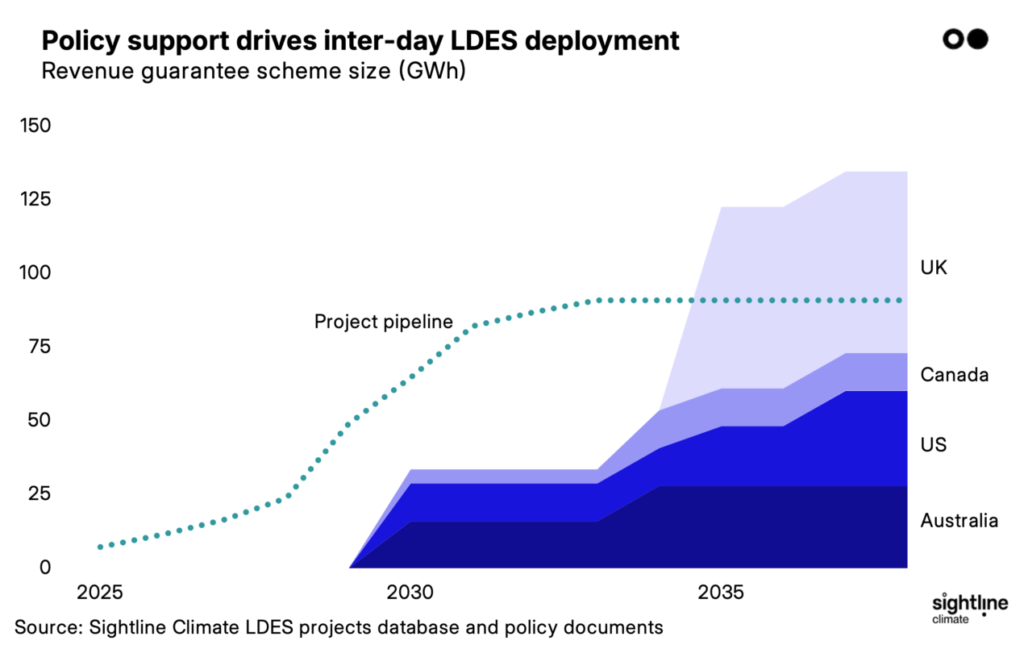

Few LDES projects are profitable today, and so policy dictates deployment. Governments support tech development with grants and early access to debt finance, but commercialisation will depend on a set of policies that guarantee project revenues and allow developers to access debt financing.

For instance, incentives and mandates in New South Wales and California have made them LDES hotspots, with 41% (26.8GWh) and 35% (22.8GWh) of the global 2030 pipeline, respectively. In New South Wales, 94% of this capacity is lithium-ion; the tech also has a 64% share in California. Policy support will ramp up in the 2030s, offering revenue guarantees for up to 148.7GWh (17.9GW) of inter-day LDES by 2037 (below).

Because it is dependent on subsidies, long duration energy storage buildout has been slow. Only 5.2GWh of inter-day LDES is operational, of which 3.8GWh (73%) is two gas-fired diabatic compressed air plants that came online last century. Without cost declines and faster deployment, grid operators could turn their attention to other clean firm options, like the 25GW of new advanced nuclear projects targeting operations by 2030.

However, advances in lithium-ion could enable widespread deployment without policy support. Innovation at the cell, block, and project level continues to drive down costs at all storage durations, and there are early signals that the lithium-ion ecosystem is turning its attention to longer durations. In March, CATL and Quinbrook announced a DC block optimised for 8-hour storage.

In June, Hithium started mass-production of a cell optimised for 4-hour discharge, a longer duration than most existing cells. And in July, LEAD unveiled manufacturing equipment for dry electrode coating that could unlock thick-electrode cells optimised for 8-hour duration or longer. These moves could be the first of a wave of redesigns that cut costs and boost the lifetime and efficiency of long duration lithium-ion projects.

Emerging technologies’ low fundamental cost could make inter-day LDES profitable without subsidies. By this argument, lithium-ion faces inescapable cost floors from raw materials at the cell level and balance of plant costs at the project level, but emerging technologies could achieve much lower costs through inexpensive inputs and novel designs.

For example, Form Energy has priced its 100-hour iron-air battery tech at $70-72/kWh, much cheaper than lithium-ion and inexpensive enough to attract utility customers.

Now, emerging tech needs to be deployed repeatedly and at scale to bring down costs. The step from demonstration to commercial-scale is notoriously difficult for startups, but early-moving LDES companies have combined government debt and grants to get projects to final investment decision.

For example, Highview Power’s liquid air first-of-a-kind (FOAK) and Energy Dome’s liquid CO2 tech received loans from the UK Investment Bank and European Investment Bank, respectively, while the US Loan Programs Office has guaranteed a loan to Eos Energy Enterprises’ zinc-bromine battery factory expansion and made a conditional commitment to Hydrostor’s adiabatic compressed air FOAK.

The private sector also has a role here: Breakthrough Catalyst made grants to the FOAKs of Energy Dome (59% of capex) and Form Energy (14% of capex) to unlock further debt and balance sheet finance. These funding pathways give the best emerging technologies a foothold in the LDES market as near-term alternatives to lithium-ion at GWh-scale.

California is the most likely proving ground for these LDES unicorns. The state’s 2027 centralized procurement for up to 1GW of 12-hour storage is unique in excluding long duration lithium-ion batteries. This could allow emerging tech startups to double down on their FOAKs with a portfolio of projects that allows them to reduce costs as they gain experience.

A small set of scaled-up and de-risked technologies is emerging, but they have yet to prove that they can unseat the incumbent: long duration lithium-ion. The challenge is daunting, but even a small number of exceptional companies could drive exponential LDES deployment and change the shape of the industry.

Lithium-ion is LDES, but it remains to be seen if inter-day LDES becomes more than long duration lithium-ion.

Lukas Karapin-Springorum leads long duration energy storage and grid technologies research at Sightline Climate, the market intelligence company providing tactical intelligence to investors, utilities, and corporate strategists navigating disruption. Lukas has a BA in physics and economics from Pomona College.

energy-storage