Oklo Breaks Ground on INL Nuclear Fast Reactor Project, Launches Private Fuel Recycling Facility

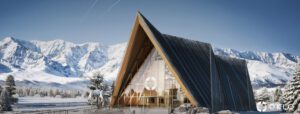

Advanced nuclear technology firm Oklo has broken ground on its inaugural 75-MWe sodium-cooled fast reactor at an Idaho National Laboratory (INL) site. The project—one of three awarded to the company under the Department of Energy’s (DOE’s) newly established Reactor Pilot Program—is targeting operations between late 2027 and early 2028, though that timeline is contingent on regulatory approvals and construction progress.

Oklo on Sept. 22 celebrated groundbreaking for its INL project—which it now calls “Aurora-INL”—noting the milestone stems from a concerted effort spanning five years. “We have been working with the Department of Energy and the Idaho National Laboratory since 2019 to bring this plant into existence, and this marks a new chapter of building. We are excited for this, and for many more to come,” said Jacob DeWitte, CEO and co-founder of Oklo.

The milestone follows Oklo’s Sept. 5 announcement that it will design, build, and operate America’s first privately funded nuclear fuel recycling facility in Oak Ridge, Tennessee. As part of that effort, the company is also exploring a pioneering collaboration with the Tennessee Valley Authority (TVA) to recycle the federal utility’s used fuel inventory. If realized, that initiative could mark the first time a U.S. utility has pursued recycling its own spent fuel into new clean electricity.

Aurora-INL—Oklo’s First Commercial Reactor—Breaks GroundSanta Clara, California–headquartered Oklo’s efforts are embedded in its vertically integrated approach, which includes advanced nuclear power generation through its Aurora powerhouses—a 50 MWe to 75-MWe liquid metal-cooled, metal-fueled fast reactor technology—fuel recycling, and radioisotope production. The company has recently reported gains toward first commercial deployments across all three business segments.

Construction activities at its first commercial reactor project—Aurora-INL—follow substantial preconstruction work, including site mobilization, early procurement, and groundwork, and are ongoing, set under a master services agreement with Kiewit, its lead constructor.

The Aurora-INL features a 50-75 MWe sodium-cooled fast reactor that builds directly on the design and operating heritage of the Experimental Breeder Reactor II (EBR-II), which operated successfully at the same Idaho site from 1964 to 1994. The powerhouse will use liquid metal sodium coolant and metallic fuel in a fast neutron spectrum design that enables inherent and passive safety features to significantly reduce the number of safety-grade systems required compared to traditional light water reactors, Oklo has said.

The design philosophy, notably, allows the reactor to utilize a diverse fuel portfolio including fresh high-assay low-enriched uranium (HALEU), downblended government stockpiles of uranium and plutonium-based materials that don’t require enrichment, and eventually recycled nuclear fuel. Oklo has said the reactor leverages over 400 reactor-years of proven liquid metal fast reactor operating history worldwide.

While the Aurora-INL is effectively Oklo’s first build, the company has also noted that the project will focus on cost efficiency and speed of deployment through strategic supply chain choices. “Roughly 70% of our powerhouse components are sourced from non-nuclear supply chains, industrials, energy and chemicals, for example,” said DeWitte during the company’s second-quarter earnings call on Aug. 11. “These sectors offer mature, scalable manufacturing capabilities that we can tap into today at lower cost and with shorter lead times than traditional nuclear fabrication.”

Oklo has structured the project around “standardized shippable components like the reactor module, steam generators, and power conversion system” to “simplify installation, support parallel builds and minimize on-site construction complexity,” while designing for “inherent and passive safety” to reduce “the number of safety-grade systems” and “streamline procurement,” DeWitte said. He pointed to the company’s “preferred supply agreement with Siemens Energy” as “a great example of this strategy in action,” noting that Oklo continues to expand the supplier ecosystem “with more partnerships to come as those deals reach commercial readiness.” The company has also tapped engineering giant Kiewit under “a master services agreement” covering “the full scope of design, procurement and construction for the Aurora-INL project,” he said.

Several more reactor projects could follow. Oklo recently broadened its 14-GW pipeline with a partnership with Liberty Energy to launch an integrated gas-to-nuclear power solution, a Notice of Intent to Award from the U.S. Air Force for the first advanced fission deployment at a military installation, and agreements with Vertiv to co-develop data-center power and cooling systems, as well as with Korea Hydro & Nuclear Power to explore global project development.

So far, Oklo has made substantial regulatory progress across multiple fronts, including to complete Phase 1 of the Nuclear Regulatory Commission’s (NRC’s) readiness assessment for Aurora-INL’s combined license application (COL) under Part 52. Unlike the traditional Part 50 approach that involves two steps: the filing and approval of a construction permit followed by the filing and approval of an operating license, the company is pursuing Part 52 licensing because it “enables greater deployment speed and repeatability for companies like Oklo that plan to design, construct, and operate their own facilities,” with “the first combined license application serv[ing] as a reference, which can then be reused to reduce the scope of subsequent applications,” the company says in a regulatory dashboard on its website.

“Oklo is pioneering this approach in the advanced nuclear industry: it remains the only advanced reactor company to submit a combined license application and the first to have that application accepted for review,” it notes.

In August, however, the DOE selected the company for three projects of 11 selected under its new Reactor Pilot Program—two awarded directly to Oklo and one to its radioisotope arm, Atomic Alchemy—which seek to reach criticality of at least three advanced reactor concepts outside national laboratories by July 4, 2026.

A key facet of the program is that it allows private developers to build and operate reactors using DOE-issued permits rather than NRC licenses. The program leverages the DOE’s authority under the Atomic Energy Act to exempt reactors built “under contract with and for the account of” the department from traditional NRC licensing requirements.

DeWitte in August noted that President Trump’s May 2025 executive orders are “setting the stage for completely different licensing pathways” where “there is a path potentially to having a regulatory review done under the DOE, build the plant, turn it on,” which could “accelerate timelines considerably” as an alternative to the traditional NRC route. For Oklo’s Aurora-INL project, that aspect potentially creates optionality while the company continues pursuing its NRC combined license strategy.

Notably, the NRC recently revised its Nuclear Energy Innovation and Modernization Act (NEIMA) milestones to align with the 12- and 18-month periods cited in Executive Order 14300 (Ordering the Reform of the Nuclear Regulatory Commission), establishing 18 months for all reactor licenses under Part 52. (The measure, which took effect on May 23, also set various 12-month targets for license amendments, renewals, and other regulatory activities.)

In tandem, the company is also progressing on the Aurora-INL Fuel Fabrication Facility (A3F), which is currently funneling through the DOE’s safety analysis process—including completion of its conceptual safety design and ongoing development of the preliminary safety analysis. The facility will fabricate fuel for Oklo’s Aurora-INL powerhouse, which requires high-assay, low-enriched uranium (HALEU). Oklo plans to source five metric tons of HALEU from the former EBR-II reactor.

“The project is expected to create approximately 370 jobs during construction and 70–80 long-term, highly skilled roles to operate the powerhouse and A3F,” Oklo noted on Monday.

Oklo Unveils Nation’s First Private Nuclear Fuel Recycling Facility, Eyes TVA Used Fuel PartnershipThe Aurora-INL groundbreaking, meanwhile, comes on the heels of Oklo’s plans unveiled on Sept. 5 to design, build, and operate America’s first privately funded nuclear fuel recycling facility in Oak Ridge, Tennessee. The company said the initial phase of that facility had secured $1.68 billion in investment, which would bolster its construction and potentially position it to begin producing fuel in the early 2030s.

Earlier this month, Oklo also noted it is in early discussions with the federal corporation TVA to recycle the utility’s used nuclear fuel at the new facility, while also exploring potential power sales from future Aurora powerhouses into TVA’s service territory. If realized, the collaboration could mark “the first time a U.S. utility has explored recycling its used fuel into clean electricity using modern electrochemical processes, turning a legacy liability into a resource while creating a secure fuel supply for the future,” Oklo said.

The Tennessee nuclear fuel recycling facility, which is slated to mark the first commercial-scale deployment of electrochemical recycling technology in the U.S., will “recover usable fuel material from used nuclear fuel and fabricate it into fuel for advanced reactors,” including fast reactors like Oklo’s Aurora powerhouses. “This process can reduce waste volumes for more economical, clean, and efficient disposal pathways,” the company said.

Oklo has made some gains in demonstrating its pyroprocessing technology, including a successful end-to-end recycling process with Argonne National Laboratory in July 2024. Essentially, Oklo’s pyroprocessing process will involve converting spent nuclear fuel (SNF) from light water reactors (which is in the form of ceramic oxide) to a metallic form. The initial preparation step removes the oxygen and prepares the fuel for the electrochemical separation. The metallic spent fuel is then placed in the molten salt environment, to which an electrical current is applied. The electrorefining process selectively separates the different components of the spent fuel, including the uranium, transuranic elements (such as plutonium and minor actinides), and fission products, including a range of radioisotopes.

In tandem, Oklo has been investigating the potential to harvest the valuable radioisotopes through its strategic subsidiary, Idaho-based Atomic Alchemy. Atomic Alchemy—also a selection under the DOE’s Reactor Pilot Program—has already begun site characterization work on a commercial isotope production facility at INL and has submitted a materials license application to the NRC for its demonstration facility, which will produce revenue-generating isotopes as an early step toward commercial operations. The subsidiary is also developing the Versatile Isotope Production Reactor (Viper), which it says is designed as a cost-effective approach to radioisotope production. DeWitte has compared the technology to “a Ford F-150 version of a reactor that does the job” rather than “a custom Formula 1 race car.” It will allow the company to “make neutrons more cheaply than maybe anything else to irradiate these materials and produce them,” he said.

A Turning Point for U.S. Nuclear Fuel Recycling?The launch of the Tennessee facility signals a major shift for the U.S. nuclear policy and industry, which has grappled with an impasse on SNF disposal alongside a looming shortage of HALEU fuel needed for advanced reactors. According to the DOE, over 95,000 metric tons of SNF are safely stored across 79 sites in over 30 states.

As POWER recently reported, while nuclear fuel recycling is not new, previous efforts to establish nuclear fuel recycling in the U.S., dating back to the 1960s and 1970s, faltered owing to regulatory, political, and economic hurdles and suffered a setback when President Carter indefinitely deferred commercial reprocessing in 1977. Momentum for nuclear recycling has soared in recent months, driven by explicit federal policy shifts, including the May 2025 executive orders.

At the same time, recycling prospects are looking more attractive, underpinned by soaring demand for HALEU from advanced reactors, billions in private-sector investment in new demonstration plants, technological advances that cut recycling costs and enhance proliferation resistance, and active NRC engagement on regulatory pathways. Generally, recycling prospects are also riding on a reframing of SNF as a high-value resource capable of supplying vast energy while slashing waste volumes are collectively driving nuclear fuel recycling forward in the U.S.

In August, DeWitte noted that recycling offers a “massive reserve of material” since “used fuel is effectively 90-plus percent unused fuel. “ When combined with Oklo’s fast reactor technology, it enables “a very cost-transformative” approach where “the actual fuel produced from recycling will be a much lower cost than fresh fuel, like considerably less,” he said. Government stockpiles of downblended uranium and plutonium-based materials alone “could be made into fuel for more than 3 GW of powerhouses” without requiring additional enrichment, he said.

“Fuel is one of the most important inputs for advanced nuclear, and it’s one of the areas where Oklo has built a significant strategic advantage,” he explained. “Our design enables a differentiated fuel strategy built around three complementary sources: access to government stockpiles, commercial supply partnerships, and long-term recycling capabilities. This approach provides greater flexibility, cost control, and resilience than traditional fuel models.”

While the DOE in 2019 awarded the company 5 metric tons of HALEU for its first INL powerhouse, “we’re uniquely positioned to utilize additional government fuel stockpiles made available under recent executive orders, including enriched uranium and plutonium-based materials that don’t require further enrichment,” DeWitte said. “These stockpiles, effectively waste materials that would otherwise be destined for costly disposal programs can instead be turned into a productive asset for clean energy by Oklo.”

Second, Oklo is “working with enrichers such as Centrus and Hexium to meet both near-term and long-term commercial HALEU needs,” DeWitte said. The company has a signed memorandum of understanding with Centrus, which is “currently the only domestic producer of HALEU,” to supply Oklo powerhouses for early deployment. At the same time, Oklo is collaborating with Hexium to explore a laser-based enrichment method—atomic vapor laser isotope separation (AVLIS)—that DeWitte said “has the potential to significantly change cost curves” and enable “lower cost scalable production over time.” He also noted that advances in laser technology over the past 30 to 40 years make this “an interesting time now for this” approach, which could deliver “significant improvements in efficiency, cost, and operational characteristics” compared to centrifuge enrichment.

And third, “Our fast reactors can use recovered nuclear material from both today’s nuclear fleet and future advanced reactors, positioning us to recycle fuel over time and build a vertically integrated long-term supply model,” he said. “Together, these efforts form a comprehensive and resilient fuel strategy, one that supports near-term deployment, while building long-term supply independence.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).

powermag